US Economy Shows Mixed Signals Ahead of 2026: Inflation, Spending, and Federal Reserve Signals Raise Concerns

Overview of recent US economic indicators

As the United States approaches the end of 2023, recent economic data reveals a landscape marked by both optimism and concern. Over the past ten days, key indicators surrounding inflation trends, consumer spending, and signals from the Federal Reserve have painted a mixed picture of the nation’s economic health, raising questions about the potential impact on American households heading into early 2026.

### Inflation Trends: A Persistent Challenge

According to the latest report from the Bureau of Labor Statistics, the Consumer Price Index (CPI) rose by 0.4% in September, a slight uptick from previous months. Year-over-year inflation remains at approximately 3.7%, down from peaks earlier in 2022 but still above the Federal Reserve's target of 2%. While energy prices have stabilized, food and housing costs continue to exert upward pressure on inflation.

Economists note that the persistence of inflation could be attributed to ongoing supply chain disruptions and the rising costs of essential goods. "The inflation we are experiencing is not just a fleeting issue," comments Dr. Lisa Chen, an economist at the Brookings Institution. "It's a complex interplay of global events, including geopolitical tensions and climate-related disruptions, that affect supply chains."

### Consumer Spending: Signs of Caution

Consumer spending, which accounts for nearly two-thirds of U.S. economic activity, showed some resilience but is beginning to show signs of strain. Recent data from the Commerce Department indicates that retail sales increased by only 0.2% in September, compared to a robust 0.7% in August. Analysts suggest that the slowdown could be a reflection of consumers feeling the pinch of rising prices and higher interest rates.

"It appears that consumers are starting to pull back," noted David Roberts, Chief Retail Analyst at Market Insights. "While discretionary spending on travel and dining remains strong, essentials such as groceries and utilities are taking a larger share of household budgets. This shift could signal trouble for the retail sector if it continues."

Additionally, a recent survey by the Conference Board found that consumer confidence dipped slightly in October, with respondents expressing concerns about inflation and job security. This sentiment could lead to further reductions in spending and, consequently, economic growth as we enter 2024.

### Federal Reserve Signals: A Tightrope Walk

In the wake of these mixed signals, the Federal Reserve is faced with the challenging task of navigating monetary policy to support growth while keeping inflation in check. During a recent meeting, Fed Chair Jerome Powell emphasized the need for a cautious approach, stating, "We remain committed to our dual mandate of price stability and maximum sustainable employment. The path forward is uncertain, and we must be prepared to adjust our tactics as needed."

The central bank's decision to pause interest rate hikes in its latest meeting has been met with both relief and skepticism. While maintaining rates at a 5.25–5.50% range may alleviate immediate pressure on borrowers, many economists argue that inflationary forces are still at play, which may necessitate further tightening in the months to come.

"As we head into 2026, the Fed's actions will be crucial," explains Dr. Maria Lopez, a monetary policy expert at the National Economic Council. "If inflation remains stubbornly high, we could see rates rise again, which would increase borrowing costs for consumers and businesses alike."

### Risks Ahead: Economic Forecast for Early 2026

As the economic landscape evolves, several risks loom on the horizon for early 2026. Experts warn that a potential recession could be on the cards if inflation does not subside and if consumer spending continues to falter.

The labor market, while currently robust, could show signs of strain if businesses begin to cut back on hiring in response to rising costs and decreasing consumer demand. Additionally, the impact of student loan repayments resuming this fall could further squeeze household budgets, potentially leading to a decline in discretionary spending.

"Americans may start to feel the weight of these economic pressures more acutely as we move into 2024," warns economist Sarah Patel. "With less disposable income, families may have to re-evaluate their spending habits, which would have downstream effects on businesses and the overall economy."

### Conclusion: A Balancing Act

As we near 2026, the U.S. economy stands at a crossroads. The mixed signals from inflation data, consumer spending, and Federal Reserve policy indicate a balancing act that will require careful monitoring. Americans are likely to feel the impact of these economic fluctuations in their daily lives, from rising prices at the grocery store to higher interest rates on loans.

The road ahead is fraught with uncertainties, but one thing remains clear: the economic decisions made today will shape the financial landscape of the nation in the years to come. Stakeholders at all levels must remain vigilant and adaptable as they navigate the complexities of an evolving economy.

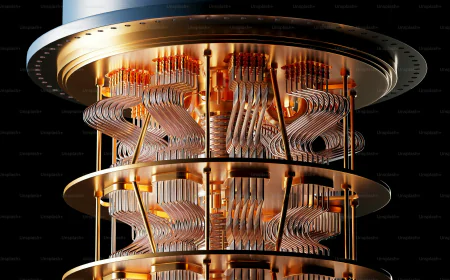

Technical Evolution and Creative Innovation

The innovation showcased in this recent development highlights the transformative potential of modern digital tools in reshaping audience engagement. Industry leaders argue that the integration of advanced predictive analytics and human-centric design is no longer a luxury but a necessity for staying relevant in a competitive market. This shift also raises important ethical questions regarding data privacy and the role of automated decision-making in creative processes. As technology continues to bridge the gap between imagination and reality, the standards for quality and authenticity are expected to evolve significantly by 2026.

Article written by: Marcus Vane

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

:max_bytes(150000):strip_icc():format(webp)/iphone-17-pro-d7ae6571d5b147ab8312e83b4d30a5a9.jpg)