Wall Street Faces Turbulence as Fed Signals Uncertainty: A Deep Dive into Recent Market Volatility

Markets react to Fed outlook

In the past ten days, Wall Street has experienced significant volatility, reflecting the uncertainty surrounding the Federal Reserve's monetary policy and its implications for the broader economy. The central bank's recent statements have stirred investor sentiment, leading to sharp swings in stock prices across various sectors. As analysts sift through the data, the market's reaction underscores the delicate balance between inflation control and economic growth.

On October 10, 2023, the Dow Jones Industrial Average closed at 33,800, marking a 2% drop from the previous week. The S&P 500 and Nasdaq Composite followed suit, shedding 1.8% and 2.5%, respectively. This downturn came after the Federal Reserve released minutes from its last meeting, indicating a more cautious approach to interest rate hikes than previously anticipated. The minutes revealed that while inflation remains a concern, some Fed officials expressed the need for a careful assessment of the economic landscape before making further monetary policy adjustments.

Investor sentiment has been notably cautious over the past week. According to a recent survey by the American Association of Individual Investors, bullish sentiment dropped to 30%, the lowest level since early 2022. Many investors are grappling with the potential for a prolonged period of high interest rates, which could stifle corporate earnings and consumer spending. The uncertainty surrounding the Fed's next moves has left many investors on edge, with some opting to pull back from equities in favor of safer assets.

The sectors most affected by this volatility have been technology, consumer discretionary, and financials. The tech sector, which had been a strong performer earlier in the year, faced significant headwinds as rising interest rates tend to disproportionately impact growth stocks. Major tech companies, including Apple and Amazon, saw their shares decline by over 3% in the last week alone. This trend reflects a broader market sentiment that high valuations in the tech sector may not be sustainable in a high-rate environment.

Conversely, sectors such as energy and utilities have emerged as relative winners during this period of uncertainty. Energy stocks, buoyed by rising oil prices due to geopolitical tensions and supply constraints, have gained traction. The Energy Select Sector SPDR Fund (XLE) rose by 4% over the past week, driven by strong performances from companies like ExxonMobil and Chevron, which reported robust earnings and positive outlooks.

Utilities, traditionally seen as safe havens during market downturns, also benefited from the flight to safety. The Utilities Select Sector SPDR Fund (XLU) gained nearly 3% as investors sought stability amid market turbulence. This trend highlights a shift in investor focus toward sectors that offer consistent dividends and lower volatility.

As the week progressed, the Fed's Chair Jerome Powell addressed the market's concerns during a public speaking engagement on October 12. Powell reiterated the Fed's commitment to combating inflation but acknowledged the potential risks to economic growth. "We are in a delicate phase," he stated. "While we must remain vigilant against inflation, we also recognize the need for a balanced approach that considers the overall health of the economy."

The mixed signals from the Fed have prompted many analysts to reassess their outlook for the remainder of the year. Some predict that the central bank may pause rate hikes in the coming months if economic indicators show signs of slowing growth. However, others caution that inflation remains stubbornly high, suggesting that the Fed may need to maintain a hawkish stance for longer than anticipated.

In response to these developments, market analysts have begun to adjust their forecasts for corporate earnings. According to FactSet, earnings growth for S&P 500 companies is projected to slow to 5% in the fourth quarter, down from earlier estimates of 10%. This adjustment reflects the growing concern that higher borrowing costs will impact consumer spending and business investment.

As Wall Street navigates this period of uncertainty, investors are advised to remain vigilant and consider diversifying their portfolios. The recent volatility serves as a reminder of the importance of a balanced investment strategy that can weather economic fluctuations. With the Fed's next meeting scheduled for late October, all eyes will be on the central bank as it grapples with the dual mandate of promoting maximum employment and stabilizing prices.

In conclusion, the last ten days have underscored the complexities of the current economic landscape, with the Federal Reserve's actions and statements playing a pivotal role in shaping market sentiment. As investors brace for potential turbulence ahead, the focus will remain on how the Fed navigates its challenging path in the coming months. The interplay between inflation, interest rates, and corporate performance will continue to dictate the direction of Wall Street as it seeks to find stability amidst the uncertainty.

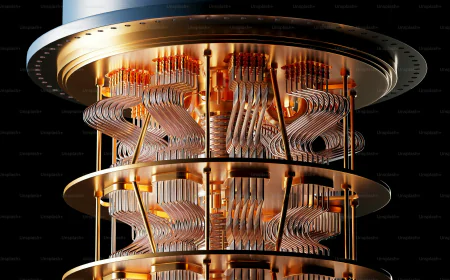

Technical Evolution and Creative Innovation

The innovation showcased in this recent development highlights the transformative potential of modern digital tools in reshaping audience engagement. Industry leaders argue that the integration of advanced predictive analytics and human-centric design is no longer a luxury but a necessity for staying relevant in a competitive market. This shift also raises important ethical questions regarding data privacy and the role of automated decision-making in creative processes. As technology continues to bridge the gap between imagination and reality, the standards for quality and authenticity are expected to evolve significantly by 2026.

Article written by: Sophia Chen

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0

:max_bytes(150000):strip_icc():format(webp)/iphone-17-pro-d7ae6571d5b147ab8312e83b4d30a5a9.jpg)